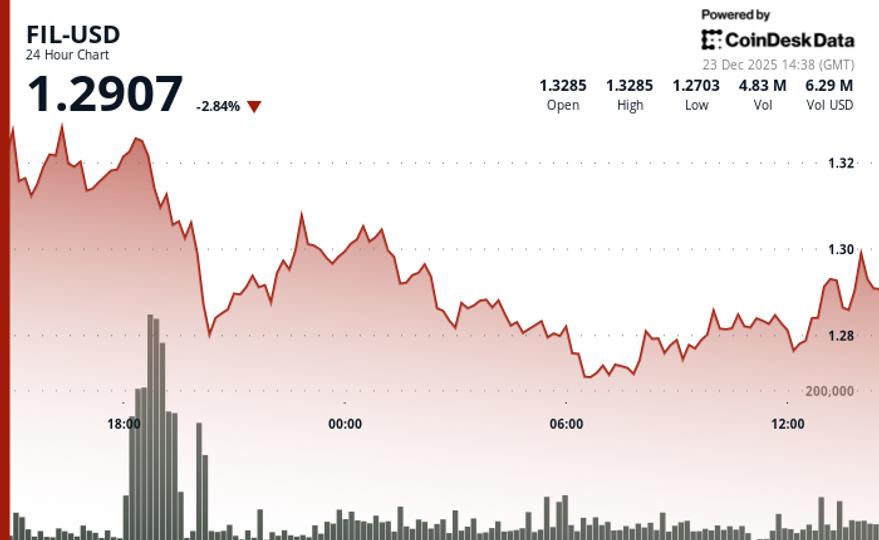

Filecoin (FIL) drops as bears test support

Filecoin drops as bears test support The storage token faced selling pressure at the $1.33 resistance level while institutions accumulated on the dips. What to know: FIL declined from $1.32 to $1.29 over 24 hours as a bearish channel pattern emerged. Trading volume was 180% above average during the rejection from $1.33 resistance. A sharp bounce from $1.28 support signals institutional buying interest at key levels. Filecoin retreated 2.2% over 24 hours, slipping from $1.32 to $1.29 as technical sellers dominated price action. Filecoin drops 2% as bears test support. The decentralized storage token established a clear bearish channel pattern with successive lower highs confirming downward momentum across the 5 cent trading range, according to CoinDesk Research's technical analysis model. See all newsletters The model showed that volume activity told the real story. Trading exploded to 7.59 million tokens yesterday evening, 180% above the 24-hour average. This surge coincided with selling at the $1.33 resistance level, marking clear institutional distribution, according to the model. With no fundamental catalysts driving price action, technical levels became the primary battleground. The swift recovery from $1.28 support demonstrates institutional buyers remain active despite the prevailing bearish channel structure, the model said. The weakness in FIL came amid a decline in wider crypto markets. The CoinDesk 20 index was 3.1% lower at publication time. Technical Analysis: Critical support holds at $1.28 following intraday liquidation event Key resistance barrier at $1.33 where institutional selling emerged Peak volume spike to 7.59 million tokens confirms major distribution activity Descending channel pattern shows successive lower highs confirming bear trend V-shaped reversal from $1.28 proves institutional accumulation appetite Immediate upside target at $1.31-$1.32 offers 3.5% gain potential Break below $1.28 key support opens path to $1.26 extension Current risk/reward favors long positioning with stops below $1.2800 Disclaimer : Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy . More For You State of the Blockchain 2025 L1 tokens broadly underperformed in 2025 despite a backdrop of regulatory and institutional wins. Explore the key trends defining ten major blockchains below. What to know: 2025 was defined by a stark divergence: structural progress collided with stagnant price action. Institutional milestones were reached and TVL increased across most major ecosystems, yet the majority of large-cap Layer-1 tokens finished the year with negative or flat returns. This report analyzes the structural decoupling between network usage and token performance. We examine 10 major blockchain ecosystems, exploring protocol versus application revenues, key ecosystem narratives, mechanics driving institutional adoption, and the trends to watch as we head into 2026. More For You Bitcoin bulls eye possible tailwind as U.S. dollar index continues to leg lower Metals and other hard assets continue their surge to new records as the greenback stumbles, but crypto has not responded. What to know: The U.S. dollar is trading near a three-month low and just above a major...

Preview: ~500 words

Continue reading at Coindesk

Read Full Article