Bitcoin’s $70,000 to $80,000 zone highlights gap in historical price support

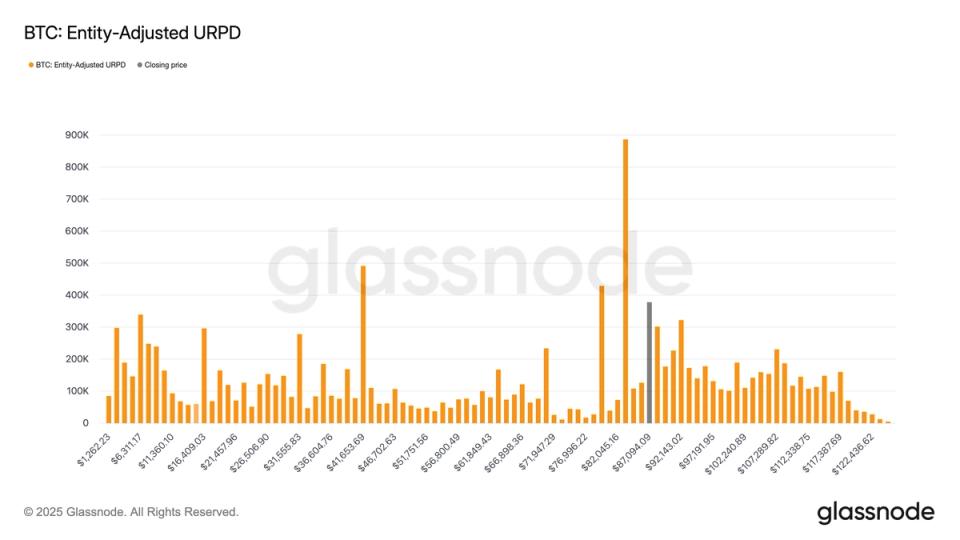

Bitcoin’s $70,000 to $80,000 zone highlights gap in historical price support Five years of CME futures data shows where bitcoin has, and has not, built meaningful price support. What to know: Bitcoin has spent relatively little time between $70,000 and $80,000, just 28 trading days, making that level among the least developed price ranges in terms of historical consolidation and support. This lack of time spent is reinforced by Glassnode’s UTXO Realized Price Distribution, which shows limited supply concentrated between $70,000 and $80,000, suggesting that if another pullback occurs, bitcoin may need to consolidate in this zone to establish stronger structural support. By checking the past five years of bitcoin CME futures trading data, it is possible to assess where that crypto has historically spent time consolidating and, by extension, where support has been more or less established. BTC, URPD (Glassnode) BTC Trading Days (Investin.com) One useful way to frame this is by examining the number of trading days bitcoin has spent within specific price bands. The more time price has spent in a given range, the more opportunity there has been for positions to be built, which can later translate into stronger support. See all newsletters Data from Investing.com shows clear disparities across price ranges. Excluding the very brief time bitcoin traded at record highs above $120,000, BTC has spent the least amount of time in the $70,000 to $79,999 band, just 28 trading days. Further, it has spent just 49 days in the $80,000 to $89,999 range. By contrast, lower price zones such as $30,000 to $39,999 or $40,000 to $49,999 saw almost two hundred trading days, highlighting how extensively those areas were tested and consolidated. For most of December, bitcoin has been trading in that $80,000-$90,000 range following its sharp pullback from the October all-time high. That correction has retraced price back toward an area where the market has historically spent relatively little time, especially when compared with much of 2024, during which bitcoin spent a significant number of days between $50,000 and $70,000. This uneven distribution suggests that support in the $80,000s, and even between $70,000 and $79,999, is less developed than in lower ranges. This observation is reinforced by Glassnode data. The UTXO Realized Price Distribution (URPD) shows where the current supply of bitcoin last moved, using an entity-adjusted framework that assigns each entity’s full balance to its average acquisition price. The URPD indicates a noticeable lack of supply concentrated between $70,000 and $80,000, aligning with the futures data. Both datasets suggest that if bitcoin were to undergo another corrective phase, the $70,000 to $80,000 region could represent a logical area where price may need to spend more time consolidating to establish stronger support. Disclaimer: This analysis is based on the daily Open price of Bitcoin CME futures, with weekends excluded, meaning the figures reflect how often bitcoin began a trading session within each price band rather than intraday or closing price activity. More For You State of the Blockchain 2025 L1 tokens broadly underperformed...

Preview: ~500 words

Continue reading at Coindesk

Read Full Article