CG Oncology Undervalued Going Into A Busy 2026 (NASDAQ:CGON)

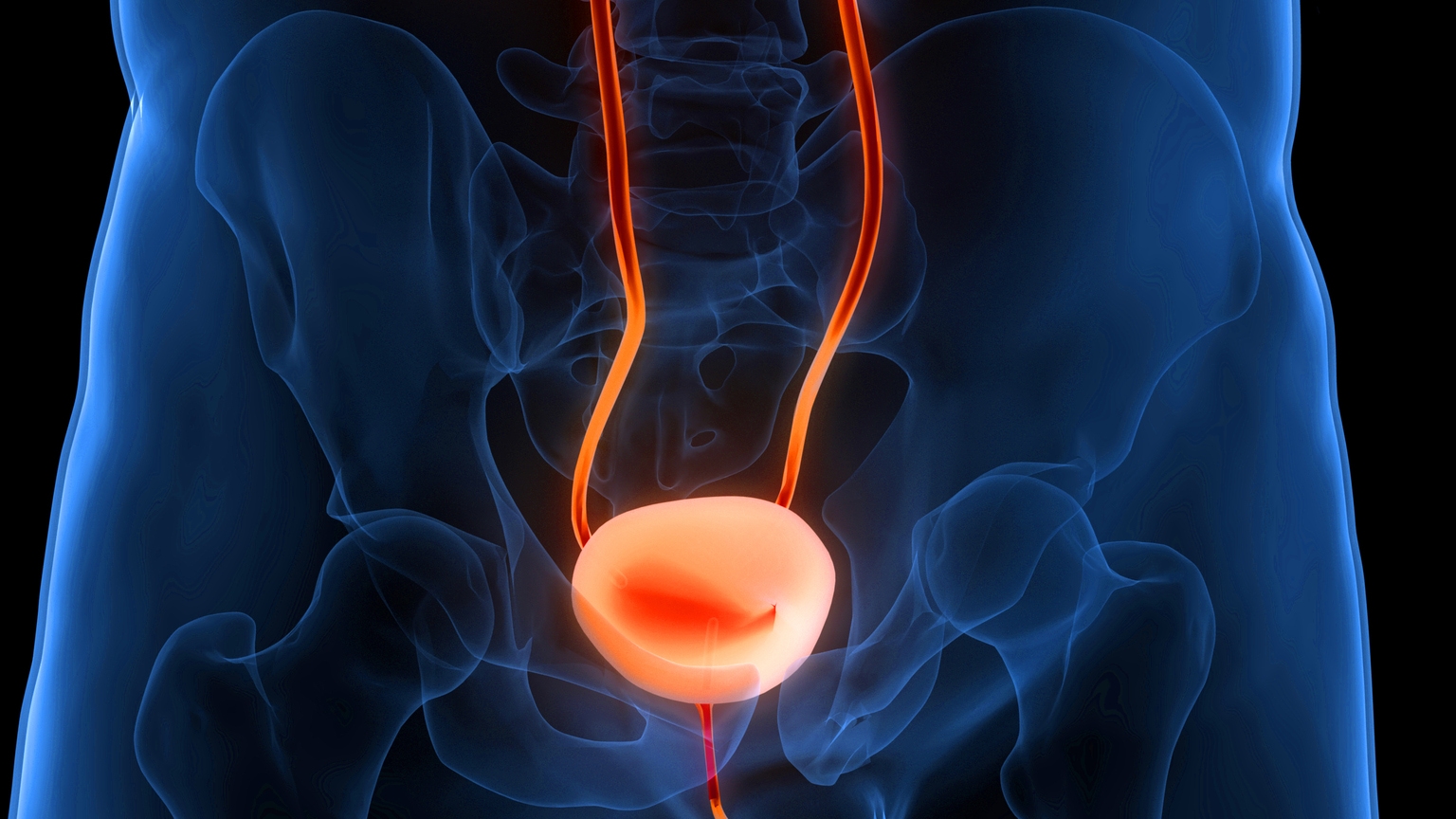

CG Oncology Undervalued Going Into A Busy 2026 Summary CG Oncology is positioned as a leading contender in high-risk BCG-unresponsive NMIBC, with its oncolytic adenovirus, cretostimogene grenadenorepvec (creto). Creto's efficacy and safety data rival JNJ’s Inlexo, with a 75.5% any-time CR rate, similar 12mo/24mo CR rates, a longer response duration, and notably fewer Grade 3+ adverse events. CGON targets $2B peak revenue in its primary indication, with meaningful upside from intermediate-risk, BCG-naïve, and muscle-invasive bladder cancer opportunities. I value CGON at $77.50/share based on over $3.5B in potential risk-adjusted peak revenue, and a buyout is a definite possibility. Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Preview: ~254 words

Continue reading at Seekingalpha

Read Full Article