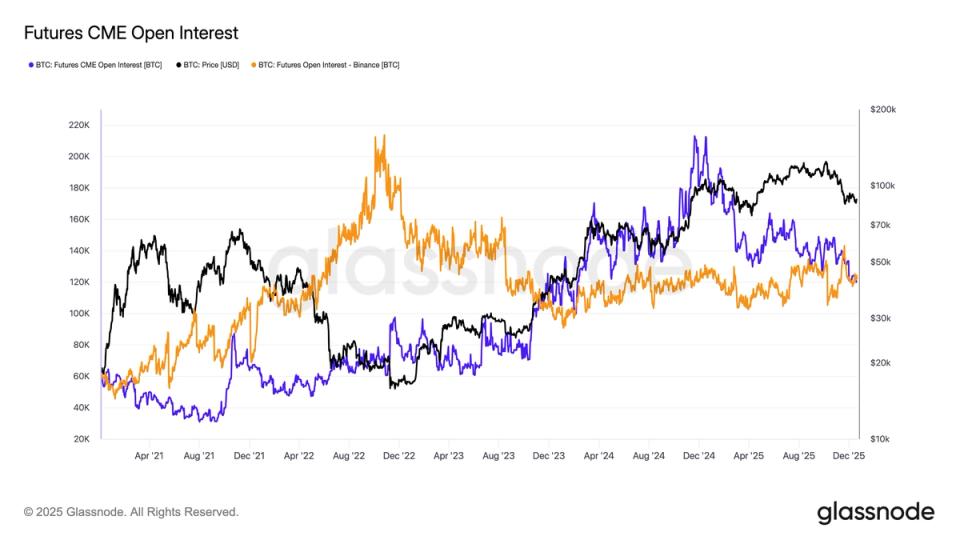

Bitcoin (BTC) news: Basis trade unwind sees Binance overtaking CME

CME loses top spot to Binance in bitcoin futures open interest as institutional demand wanes Behind the move is a sharp narrowing in the profitability of the basis trade, in which traders attempt to capture a spread by buying spot bitcoin while selling BTC futures. What to know: Binance has now become the largest venue for bitcoin futures open interest with roughly 125,000 BTC, or about $11.2 billion in notional value. CME bitcoin futures open interest has fallen to around 123,000 BTC, its lowest level since February 2024. Tightening spot futures spreads triggered basis trade unwinds and reduced institutional demand on CME. The CME has lost its place as the number one exchange for bitcoin futures open interest (OI). Binance has now overtaken CME as the largest venue by OI according to BTC Futures OI (Glassnode) CoinGlass data , with Binance holding roughly 125,000 BTC ($11.2 billion in notional value) against the CME's of 123,000 BTC ($11 billion). CME OI started the year at 175,000 BTC, but that level has steadily fallen as the profitability of the basis trade - in which traders buy spot bitcoin while simultaneously selling futures to capture the price premium between the two markets - has declined. See all newsletters Open interest on Binance, however, has remained steady throughout the year as it's the exchange more likely to be favored by retail punters betting on directional price movements. Just more than a year ago, CME OI reached a record 200,000 BTC as prices rallied toward $100,000 following President Trump’s election victory. At that time, the annualized basis rate surged to around 15%. Today, the CME that basis rate has compressed to roughly 5%, according to Velo data , reflecting diminishing returns for institutional basis traders. As spot and futures prices converge and market efficiency improves, arbitrage opportunities continue to shrink. CME had been the largest exchange for bitcoin futures OI since November 2023, driven by institutional positioning ahead of the launch of spot bitcoin ETFs in January 2024. That advantage, for the moment, appears to have faded. More For You Protocol Research: GoPlus Security What to know: As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. More For You BlackRock names bitcoin ETF a top 2025 theme despite price slump The world's largest asset manager is promoting its underperforming bitcoin fund over higher-fee winners, signaling long-term commitment....

Preview: ~500 words

Continue reading at Coindesk

Read Full Article