Prediction: Rigetti Computing Stock Is Going to Plunge in 2026 | The Motley Fool

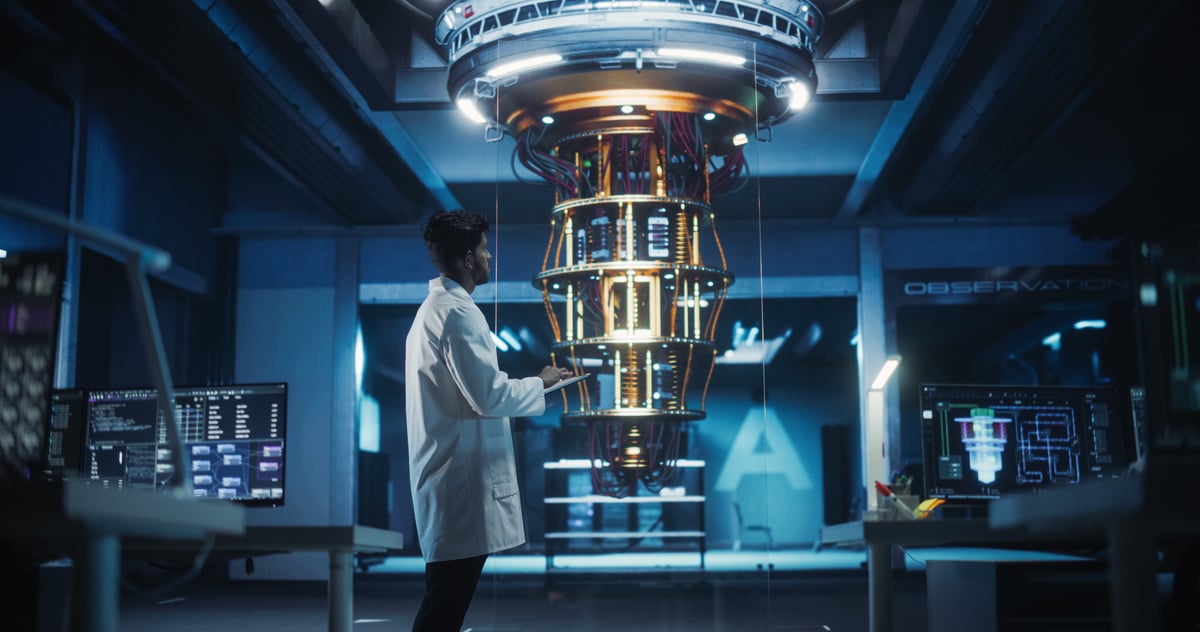

Quantum computers use a concept called superposition to simulate several different solutions to a given problem. In theory, this can speed up highly complex workloads and lead to breakthroughs in areas like science and cryptography, which is why investors have piled into quantum stocks like Rigetti Computing ( RGTI 2.39%) in 2025. However, most of the quantum computers available today still produce very high error rates, so they aren't very useful for solving real-world problems. As a result, companies like Rigetti are still a long way from commercializing their quantum platforms at scale. Rigetti stock has more than doubled over the past 12 months alone, and its market capitalization stands at $8.5 billion as I write this. But the company might struggle to maintain that valuation in 2026 based on its minimal revenue, which is why I predict its stock will plunge in the new year. Read on. Image source: Getty Images. An early leader in the quantum race Rigetti Computing was founded in 2013, and in just 12 years, it has built an entire in-house supply chain, which sets it apart from the competition. It owns a fabrication facility where it manufactures quantum chips, it designed its own quantum programming language called Quil, and it also developed a cloud computing platform where businesses can rent quantum computing capacity for a fee. Rigetti can bring updates to market much faster than other companies in this space because of its vertically integrated business, which is why it currently boasts the industry's largest multichip quantum computer. It's called Cepheus-1-36Q, and it has achieved a high fidelity of 99.5%. Fidelity measures the accuracy of each quantum operation, so a higher reading means fewer errors, thus making the computer more useful for solving real problems. Regular computers use bits, which are simple to read because they are always in a state of either 0 or 1. Quantum computers use qubits, which can take a "superposition," meaning they can assume the position of 0 and 1 at the same time. This allows them to run significantly more computations in a much shorter time span, which could transform data-intensive fields like science in the future. Cepheus-1-36Q uses four chips with 9 qubits each (36 qubits in total). But Rigetti isn't stopping there, because it intends to launch a new system with over 1,000 qubits by 2027, which could achieve a fidelity of 99.8%. In other words, the company is rapidly progressing toward commercial-grade quantum computers that businesses in many different industries might find useful. Minimal revenue, with mounting losses Rigetti generated just $5.2 million in revenue during the first three quarters of 2025 (from Jan. 1 to Sept. 30). That's a tiny amount of money for an $8.5 billion company. To make matters worse, revenue was actually down 39% from the same period in 2024. On the plus side, Rigetti secured purchase orders for two quantum computing systems in September, which should result in $5.7 million in revenue in the first half of 2026. These sales...

Preview: ~500 words

Continue reading at Fool

Read Full Article