Aptos' APT drops as token tracks broader crypto market weakness

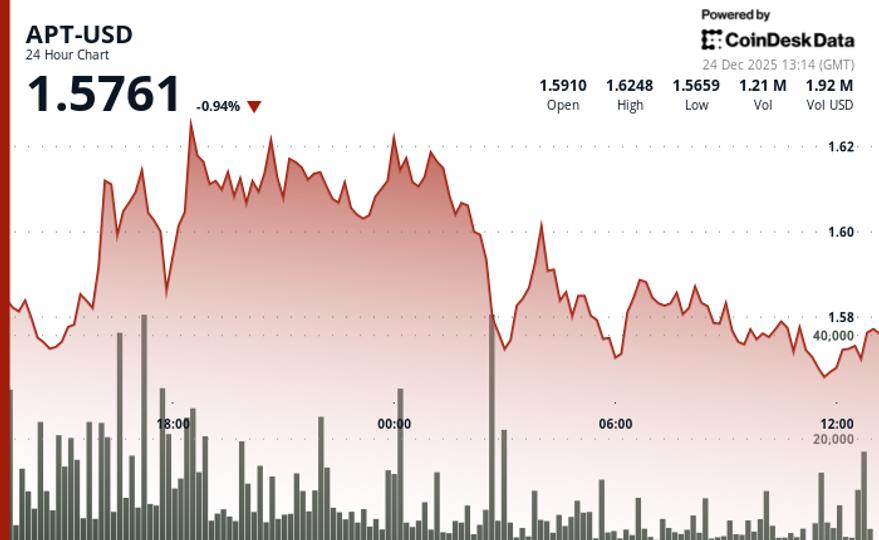

Aptos' APT drops as token tracks broader crypto market weakness APT has support at $1.56 and resistance at $1.63, per CoinDesk technical models. What to know: Aptos' APT slipped 1% to $1.56 on Wednesday. Trading activity fell 11% under the 30-day average amid holiday market conditions. APT slipped 1% to $1.56 over the last 24 hours, as wider crypto markets also retreated. The CoinDesk 20 index was 0.6% lower at publication time. Aptos' APT drops as token tracks broader crypto market weakness. The token traded between $1.62-$1.56 during the 24-hour period, establishing a $0.06 range representing 3.6% intraday volatility, according to CoinDesk Research's technical analysis model. See all newsletters The model showed a battle between bulls and bears at $1.63 resistance during evening hours. Support held firm near $1.56 as momentum faded into thin holiday trading, according to the model. Volume spiked 71% above the 24-hour average to 4.69 million tokens, coinciding with selling pressure from the session peak of $1.62, the model said. The token completed a double-bottom formation at $1.52 support before rallying through $1.56 resistance. Technical Analysis: Primary resistance holds firm at $1.66 through multiple tests while support consolidates near $1.56 11% drop in volume versus 30-day metrics signals trader fatigue, though selective spikes above 46,000 tokens reveal pockets of accumulation interest Double-bottom structure at $1.52 support triggers recent rally attempt, creating potential launch pad for moves above $1.56 resistance Upside breakout targets $1.58-$1.585 resistance cluster while breakdown below $1.56 support opens path to $1.52 retest levels Disclaimer : Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy . More For You State of the Blockchain 2025 L1 tokens broadly underperformed in 2025 despite a backdrop of regulatory and institutional wins. Explore the key trends defining ten major blockchains below. What to know: 2025 was defined by a stark divergence: structural progress collided with stagnant price action. Institutional milestones were reached and TVL increased across most major ecosystems, yet the majority of large-cap Layer-1 tokens finished the year with negative or flat returns. This report analyzes the structural decoupling between network usage and token performance. We examine 10 major blockchain ecosystems, exploring protocol versus application revenues, key ecosystem narratives, mechanics driving institutional adoption, and the trends to watch as we head into 2026. More For You WhiteFiber NC-1 deal is promising, says B. Riley, seeing 127% upside after stock price plunge The analyst team said the first long-term co-location agreement at NC-1 validates WhiteFiber’s retrofit model. What to know: B. Riley said WhiteFiber’s NC-1 Nscale deal backs the company's timeline and execution. Lender talks for a construction facility are advanced, with potential credit enhancements. The bank's analysts reiterated their buy rating on the stock while trimming their price target to $40 from $44 following the stock's more than 50% decline from record highs.

Preview: ~491 words

Continue reading at Coindesk

Read Full Article