This $27 homebuilder says the Feds are cooking up something big to ‘address’ housing market affordability

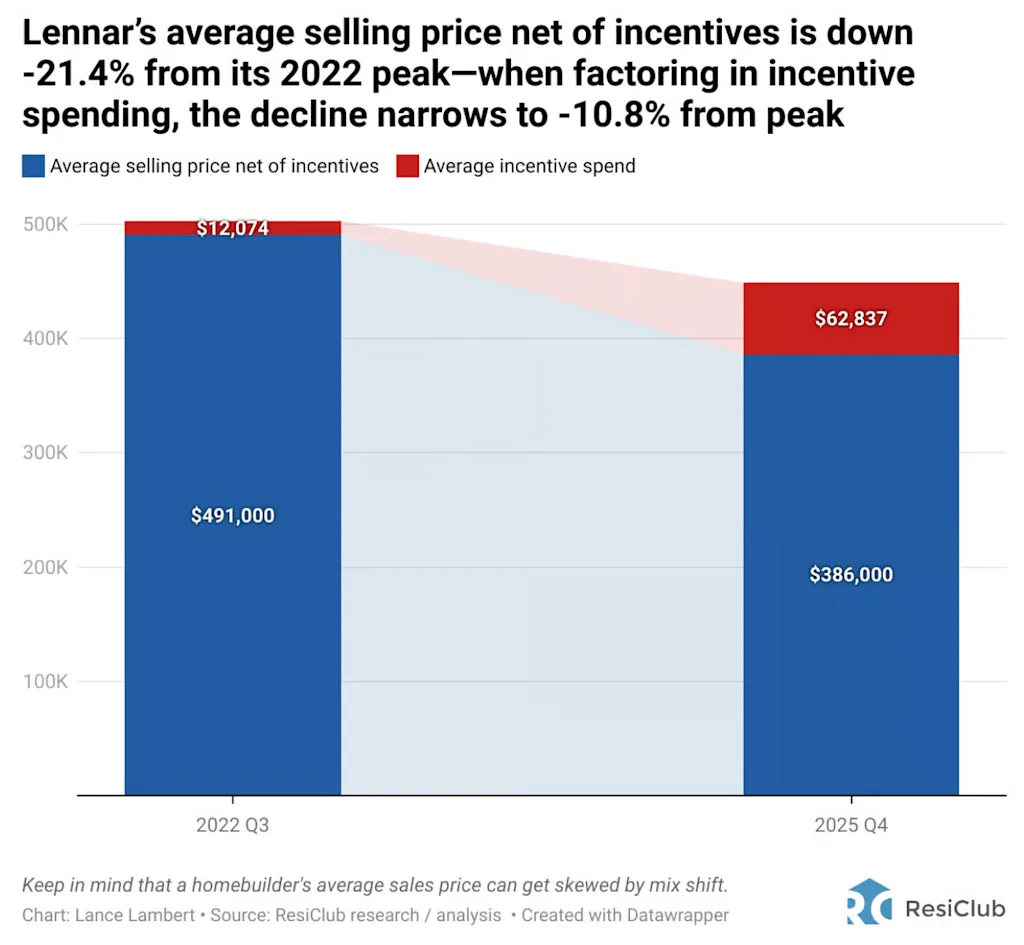

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter . During its earnings call on Wednesday, executives at Lennar—a giant homebuilder with a market capitalization of $27 billion—said the federal government is working on a plan to help alleviate strained housing affordability. Lennar executives said federal officials are actively engaging with homebuilders and industry groups to better understand constraints—and to avoid policies that could unintentionally damage supply. While no specific program was outlined, management suggested it would be “surprising” if no meaningful action emerged in 2026, given current discussions. Here’s what Stuart Miller, co-CEO of Lennar, said on its December 17, 2025, earnings call: “I think the crystal ball around government activity is really complicated, but I can tell you that a number of homebuilders have gone in to see critical officials within the [federal] government. We have received a lot of attention. There’s a lot of thought process going on. You’ve seen trial balloons put out around various types of programs. What’s interesting is that the government has been very tuned in to the industry to make sure that they’re not walking into unintended consequences. So whatever is done, that it be constructed properly, is important. And to your question of you know, do I think that something will come out in 2026? I’d be surprised if something isn’t done. I think affordability is very much on the table. It’s a political issue right now, and I think across the country, you’re hearing the drumbeat of that being a primary focal point, and politically it’s important that someone pick up the mantle and do something to address it, rather than just throw money at it. So it’ll be interesting, and we’ll have to sit back and wait and see what comes out.” This week, America’s second-largest homebuilder, Lennar, reported additional gross margin compression in the past quarter, as it had to spend more on incentives to maintain sales volume amid the soft housing market environment. To maintain sales in this softer market, Lennar spent an average of 14% of the final sales price on incentives—such as mortgage rate buydowns—in Q4 2025, up from 10% in Q4 2024. In “normal” times, Lennar’s sales incentive rate is around 5% to 6%. On its typical sale, Lennar spent $62,837 on incentives last quarter, according to ResiClub ’s analysis published on December 18. What’s interesting is that Lennar appeared to suggest to analysts on December 17 that whatever the federal government is cooking up could be enough to improve housing market conditions and reduce Lennar’s currently elevated incentive spending/improve margins. According to Miller: “The strategy is: Let us [Lennar] build the volume that the country and the consumers need. Let’s make it affordable at this time where affordability is so strained, and let’s find ways to make ourselves more efficient, and let’s expect that something is going to come through the governmental ranks to support that affordability and enable the market to enter the housing...

Preview: ~500 words

Continue reading at Fastcompany

Read Full Article