Giant homebuilder KB Home shifts strategy amid a housing market where it lacks pricing power

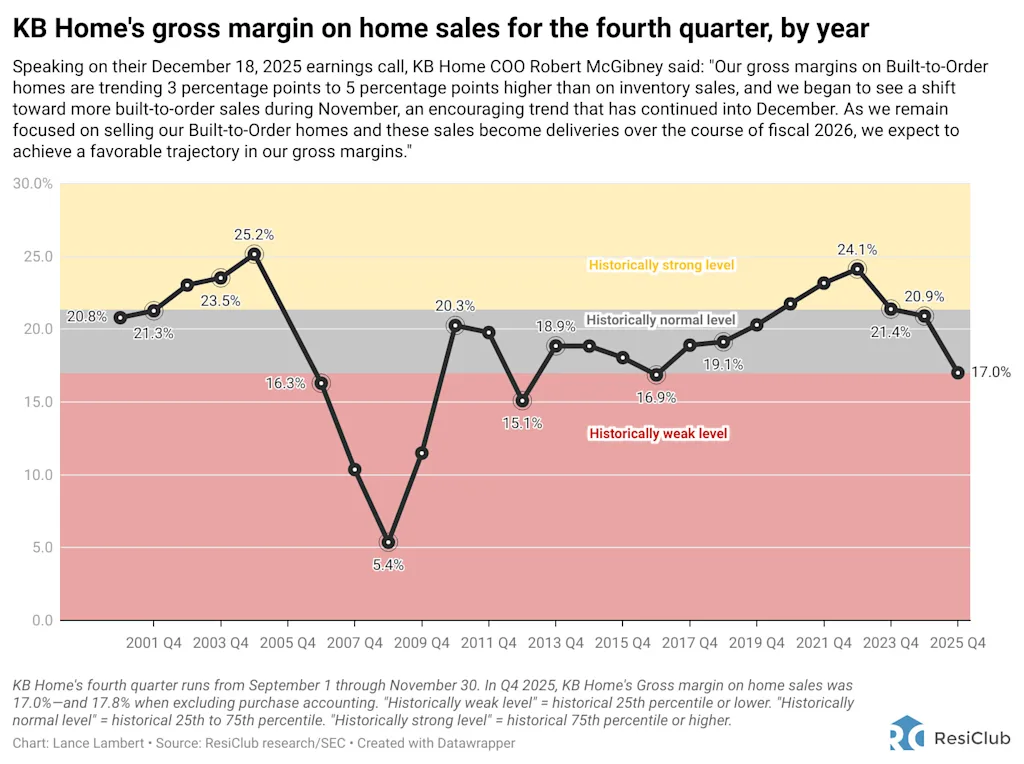

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter . There’s no doubt about it: Housing market softening across the Sunbelt—the epicenter of U.S. homebuilding—has caused homebuilders to lose pricing power over the past year. Amid the additional margin compression, some giant homebuilders are adjusting their strategies. Lennar is finally easing up a little on its market share, taking volume-over-margin strategy , while KB Home—a homebuilder ranked No. 526 on the Fortune 1000—said on December 18 that it plans to lean even harder into built-to-order (more on that below). At the end of last week, KB Home posted its Q4 2025 earnings—the three months ending November 30. During its earnings call, it underscored just how tricky the current housing market remains, even for builders that have avoided the most aggressive incentive wars and speculative inventory strategies. In today’s article, ResiClub highlights seven key takeaways from KB Home’s latest earnings. 1. KB Home’s margins compress to the lowest Q4 level since 2016 During the Pandemic Housing Boom, many publicly traded homebuilders achieved record profit margins as home prices soared and buyer demand ran red-hot. Ever since the national housing demand boom fizzled out in the summer of 2022, many large homebuilders have reduced margin and made affordability/pricing adjustments where and when needed to maintain their sales pace or prevent a bigger sales pullback. That includes KB Home, which reported a housing gross profit margin of 17% in Q4 2025—down from a Q4 cycle peak of 24.1% in Q4 2021. Its margin has now compressed to its lowest Q4 level since Q4 2016. As KB Home CFO Robert Dillard said on the company’s December 18, 2025 earnings call: “Housing gross profit margin was 17%, and adjusted housing gross profit margin, which excluded $13.7 million of inventory-related charges, was 17.8%. Adjusted housing gross profit margin was 310 basis points lower due to pricing pressure, negative operating leverage, higher relative land costs, regional mix, and product mix, which was pronounced due to the age and price of incremental volume versus guidance.” 2. KB Home’s average selling price is down 8.8% from its 2022 peak Unlike many giant homebuilders such as Lennar—which has preferred to pull the mortgage rate buydown lever when making affordability adjustments this cycle—KB Home has chosen to rely more on outright price cuts. [ Back in summer 2023 , KB Home CEO Jeffrey Mezger told me that these price cuts would be their strategy if any of their regional housing markets weakened further.] In Q4 2025, KB Home’s average selling price ($465,600) was 7.1% below Q4 2024 ($501,000) and 8.8% below its cycle peak in Q4 2022 ($510,400). While part of this decline is due to mix shift, KB Home has previously acknowledged cutting home prices over the past 18 months in markets such as Austin and San Antonio, as well as in Orlando and Jacksonville , Florida. “Average selling price declined 7% to $466,000 due to regional and product mix and general...

Preview: ~500 words

Continue reading at Fastcompany

Read Full Article