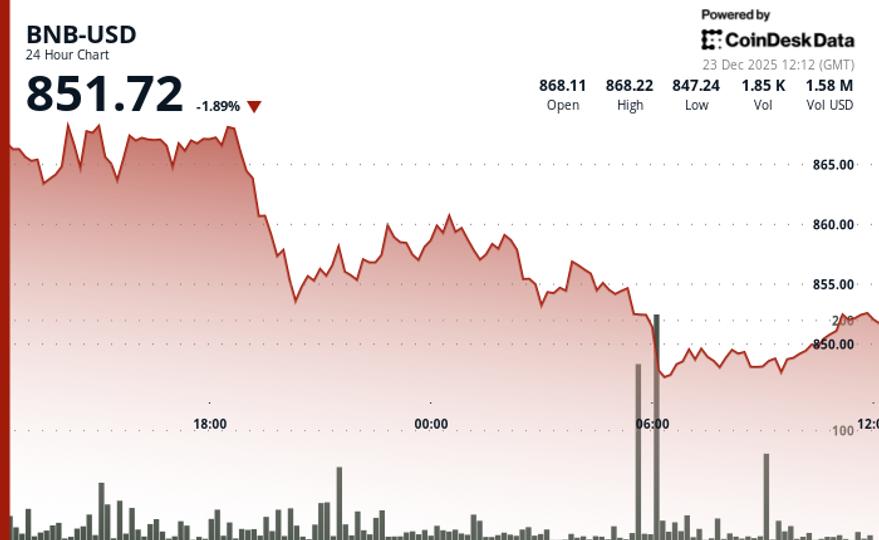

BNB price drops back to the $850 level

BNB slips toward $850 as market pullback weighs on token The decline comes as bitcoin sank back to $87,000 in Tuesday trade. What to know: The price of BNB has dropped over 1.5% over the past 24 hours to around $850. The decline comes amid a wider market drawdown, with bitcoin pulling back to the $87,000 level. Traders expect consolidation between $850 and $870, with a potential break above that range leading to a move towards $900. The price of BNB is hovering around the $850 mark after losing more than 1.5% of its value over the past 24 hours. "BNB falls 1.7% to $849 amid exchange token market cap challenges as XRP narrows gap." The token is down from a recent high near the $870 level, and comes alongside bitcoin's decline from above $90,000 to the $87,000 area on Tuesday morning. See all newsletters Price action reflected that caution. After a brief push above $860 on strong volume earlier, selling pressure returned and capped gains. The wider market is nevertheless also affected, with the wider CoinDesk 20 ( CD20 ) index, losing 2.5% of its value over the last 24 hours. Volume spikes pointed to defensive positioning rather than fresh risk-taking, according to CoinDesk Research's technical analysis data model. Not all signals were negative as adoption kept growing. Major prediction market Kalshi added deposits and withdrawals for BNB and stablecoins on the BNB Chain. For now, traders see consolidation between $850 and $870. A clear break above that range could reopen calls for a move toward $900 later in the year, while a drop below $820 would suggest deeper losses. Disclaimer : Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy. More For You State of the Blockchain 2025 L1 tokens broadly underperformed in 2025 despite a backdrop of regulatory and institutional wins. Explore the key trends defining ten major blockchains below. What to know: 2025 was defined by a stark divergence: structural progress collided with stagnant price action. Institutional milestones were reached and TVL increased across most major ecosystems, yet the majority of large-cap Layer-1 tokens finished the year with negative or flat returns. This report analyzes the structural decoupling between network usage and token performance. We examine 10 major blockchain ecosystems, exploring protocol versus application revenues, key ecosystem narratives, mechanics driving institutional adoption, and the trends to watch as we head into 2026. More For You Polkadot's DOT slips 4.5% as token underperforms wider crypto markets DOT is facing pressure as it tries to retake the $1.76 support/resistance level. What to know: Polkadot's DOT pulled back alongside a broader drop in crypto markets. DOT trading volumes dropped 9% below monthly averages, signaling weak conviction.

Preview: ~472 words

Continue reading at Coindesk

Read Full Article